Irs Quarterly Payments 2025 Vouchers

Irs Quarterly Payments 2025 Vouchers. We’ll break down everything you need to know about irs estimated tax payments, the quarterly tax. But, if you happen to miss one of your quarterly.

Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. Use this secure service to pay your taxes for form 1040 series, estimated taxes or other associated forms directly from your checking or savings account at no cost to you.

When Are Estimated Tax Payments Due In 2025?

These dates don’t coincide with regular calendar quarters, though.

We Do This To Head Off A Possible Underpayment Penalty On Next Year's Taxes.

We’ll break down everything you need to know about irs estimated tax payments, the quarterly tax.

Solved•By Intuit•108•Updated April 10, 2025.

Images References :

Source: vernahorvath.pages.dev

Source: vernahorvath.pages.dev

2025 4th Quarter Estimated Tax Payment Gabey Shelia, As the irs explains, a year has four payment periods with the following quarterly payment due dates: If your turbotax navigation looks different from what’s described here, learn more.

Source: inezcallihan.pages.dev

Source: inezcallihan.pages.dev

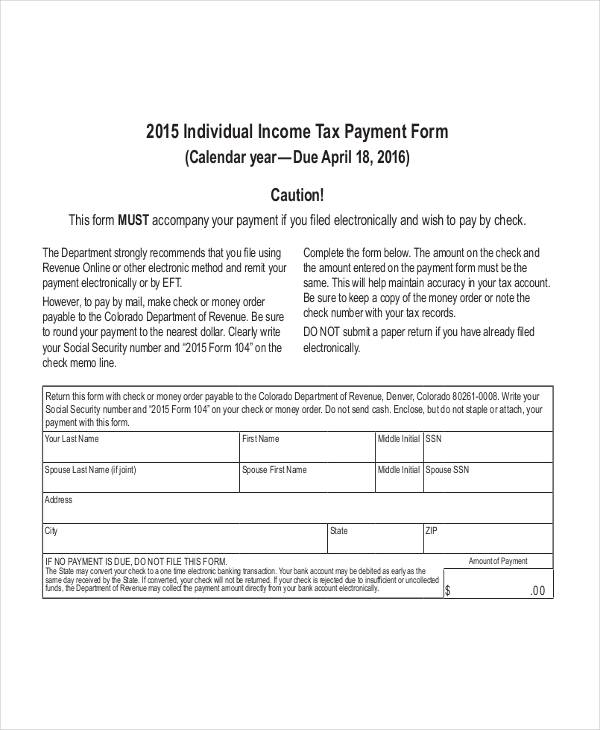

Maryland Estimated Tax Vouchers 2025 Irina Leonora, Calendar year— due april 15, 2025. If a date falls on a weekend or holiday, the.

Source: paymentpoin.blogspot.com

Source: paymentpoin.blogspot.com

How Do I Send The Irs A Payment Payment Poin, Your 2025 income tax return. This publication explains both of these methods.

Source: printableformsfree.com

Source: printableformsfree.com

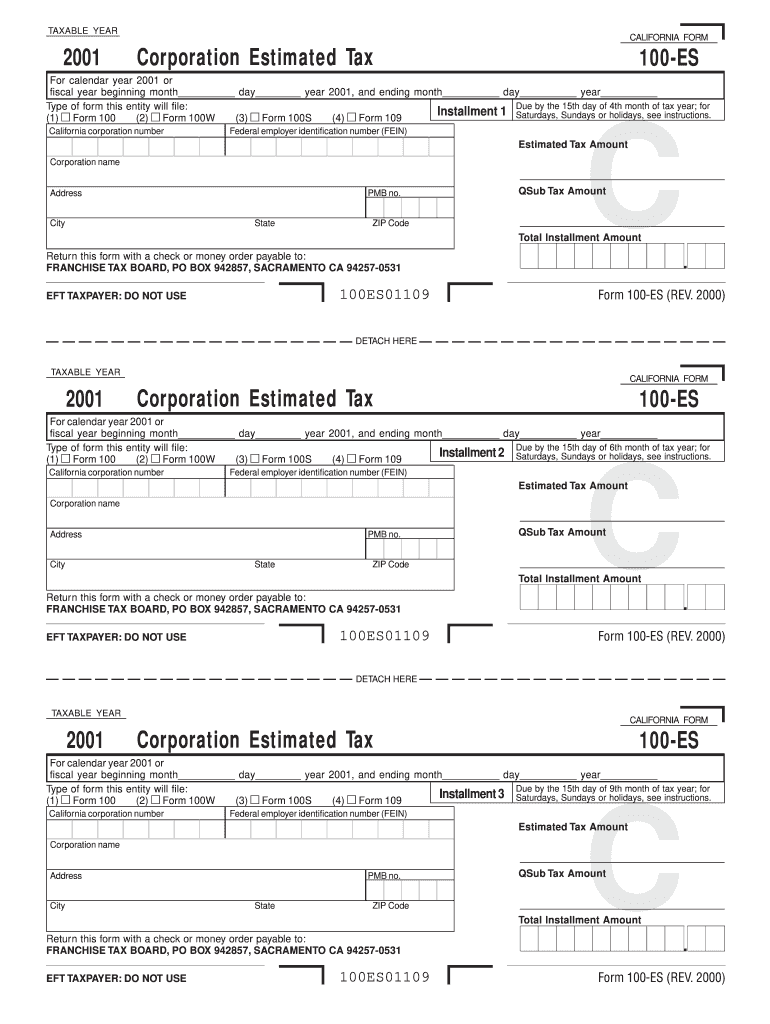

Form 100 Es 2025 Printable Forms Free Online, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments. For tax year 2025, below is the schedule of vouchers and the due dates for each quarterly payment:

:max_bytes(150000):strip_icc()/Screenshot2023-03-08at1.26.28PM-98e7ddc6d0904f378d870265beee5942.png) Source: www.investopedia.com

Source: www.investopedia.com

Form 1040 V Payment Voucher and IRS Filing Rules, Sign in to make an individual tax payment and see your payment history. When are estimated tax payments due in 2025?

Source: robertorodri.pages.dev

Source: robertorodri.pages.dev

Irs Quarterly Payment Schedule 2025 heath conchita, Direct pay with bank account. This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

Source: www.templateroller.com

Source: www.templateroller.com

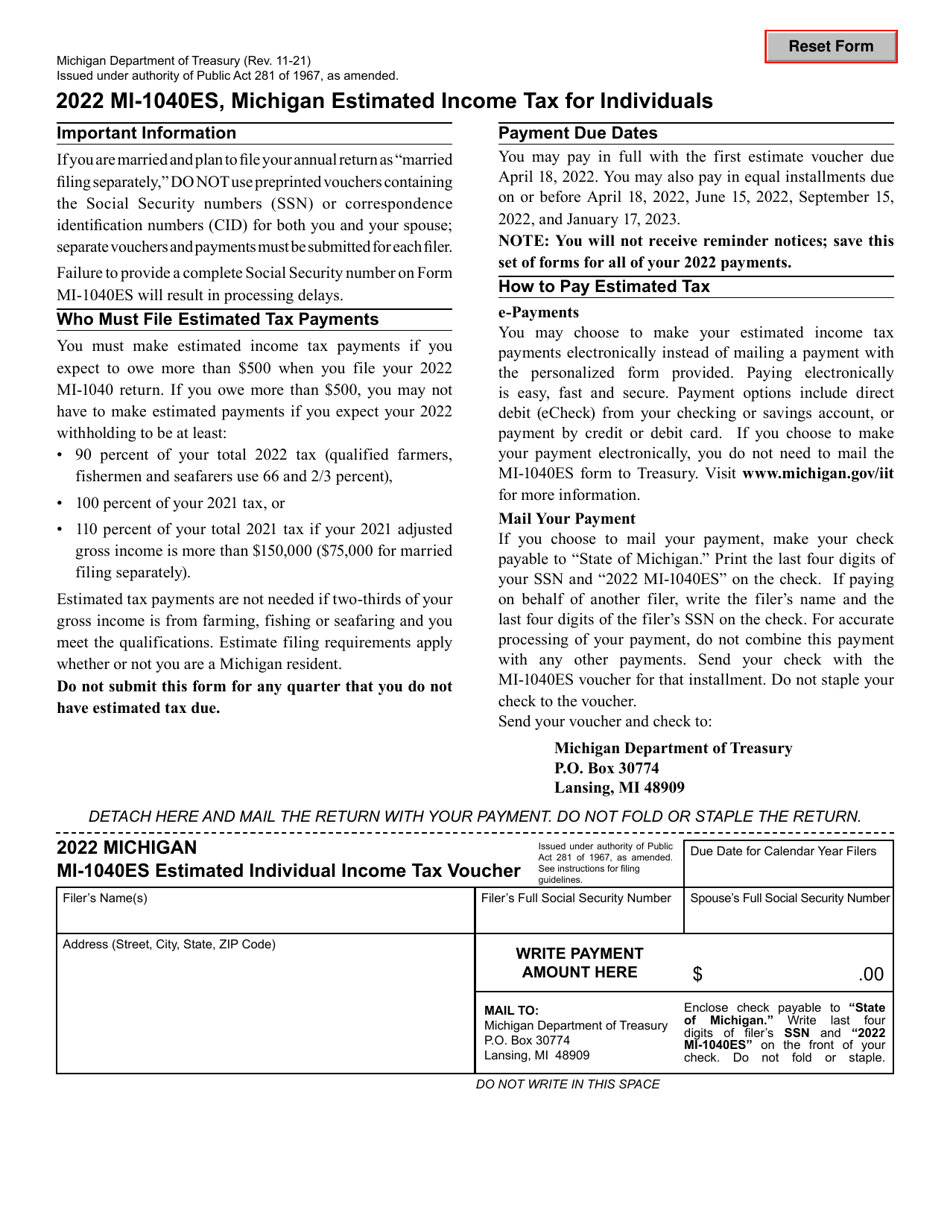

Form MI1040ES Download Fillable PDF or Fill Online Estimated, Employers engaged in a trade or business who pay compensation. If your name, address, or ssn is incorrect, see instructions.

Source: www.irs.gov

Source: www.irs.gov

3.11.10 Revenue Receipts Internal Revenue Service, The irs is reminding taxpayers who need to make estimated tax payments that the 2025 second quarter estimated tax deadline is june 17. 2025 federal quarterly estimated tax payments.

Source: kimwmelton.pages.dev

Source: kimwmelton.pages.dev

Quarterly Estimated Tax Payments 2025 Voucher Tedda Ealasaid, We're just suggesting it based on the info in your return. Mark your calendar for these deadlines in 2025, based on income from the following periods:

Source: stevenvega.pages.dev

Source: stevenvega.pages.dev

Estimated Tax Payments 2025 Irs Dacia Dorotea, For income earned in 2025, you’ll. You expect to owe at least $1,000 in federal tax for 2025, after subtracting federal tax withholding and refundable credits, and.

How To Pay Estimated Taxes.

This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

An Estimate Of Your 2025 Income.

The irs reviews this rate each quarter, and the rate for the 1st quarter of 2025 remains at 8%.